Income Tax History

Not many people realize that US income tax history has its beginnings in the American Civil War. If they did, perhaps not everyone would feel quite so good about our sixteenth President.

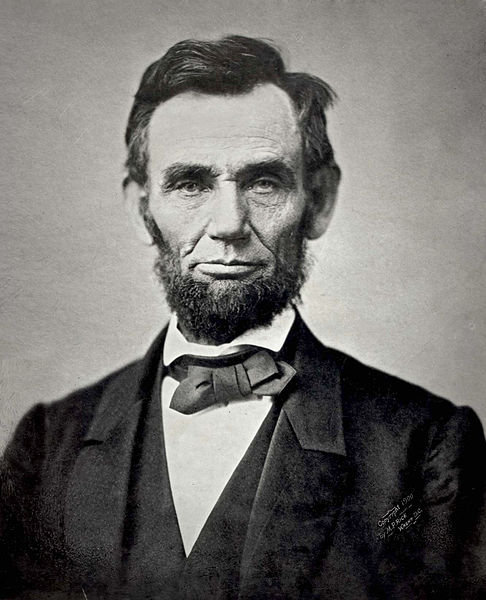

Though President Abraham Lincoln rightly holds a place as one of this nation's most beloved leaders, most people don't realize he was behind the creation one of the most reviled institutions of today's government...

The IRS!

That is right! In July 1862, Lincoln enacted the first income tax in the history of the United States; and at the same time, created a government agency that still engenders anger and fear in American citizens each and every April.

War is an expensive thing, and like every war before, the Civil War was paid for with taxes. Two taxes that were introduced then that we still face today are the inheritance tax (or death tax) and the income tax, but this page will just deal with the history of the income tax.

To Pay For A War...

To be fair, Lincoln (left) didn't come up with the idea of funding his war with an income tax. It had been done before. The US government had even considered enacting an income tax to fund the War of 1812, but the idea was never carried out.

Even though he wasn't the first to use an income tax, Lincoln was the first to institute one in the United States. Therefore, our income tax history begins with him.

Realizing that lots of money would be needed to fund a prolonged war effort, Lincoln and the US Congress enacted the Revenue Act of 1862 which created our first income tax. The rate was 3% on all incomes over $800 (roughly $18,150 today).

Later in 1862, the income level was lowered, and a higher tax bracket was created. The new tax rate was 3% on all incomes between $600 (roughly $13,600 today) and $10,000 (roughly $226,600 today), and 5% on all incomes over $10,000.

In 1864, the rates were raised, and a third bracket was added. Income tax was collected at these rates: 5% on all incomes between $600 and $5,000; 7.5% on all incomes $5,000–$10,000; and 10% on all incomes over $10,000.

Lincoln needed a government agency to ensure the collection of his newly created tax. Therefore, he created the Bureau of Internal Revenue and the office of Commissioner of Internal Revenue to oversee it.

That office still exists, and its occupant oversees everyone's favorite government agency, the Internal Revenue Service, or IRS for short. This is how the US income tax began.

Income Tax After The Civil War

After the Civil War, Lincoln's income tax remained until 1872, when it was repealed by Congress. It made a return in 1894, however; but in 1895, the supreme court declared the tax unconstitutional.

So that should be the end, right? No way!

In 1909 the Sixteenth Amendment to the US Constitution was proposed by Congress, and in 1913 it was finally ratified. The Sixteenth Amendment cleared the way for congress to reinstitute a national income tax, and we have had one ever since.

I guess there is some symmetry there. The sixteenth President created our first income tax, and the Sixteenth Amendment put the income tax in the Constitution...

...and that, friends and neighbors, is all I care to say about income tax history. I think I need a shower now.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.